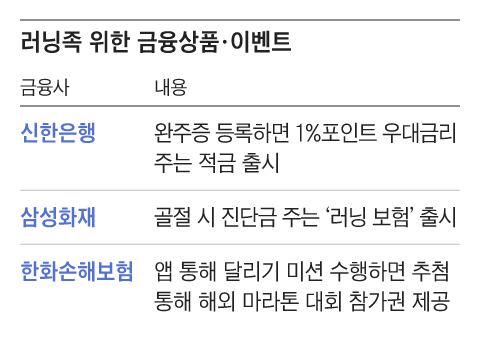

Financial Institutions Target Young Runners with Innovative Services

In recent years, a “running craze” has taken hold among younger generations, prompting financial institutions to develop unique products and marketing strategies aimed at this demographic. These initiatives blend the popularity of running with financial services, creating new opportunities for engagement and growth.

Shinhan Bank Launches ‘Shinhan 20+ Run’ Service

Shinhan Bank recently introduced the ‘Shinhan 20+ Run’ service, which merges the concept of running with financial incentives. Customers who run at least 1 km daily can accumulate points based on their total distance. This service is designed to encourage consistent physical activity while offering financial benefits.

In addition to the running program, Shinhan Bank has also launched a “running savings” product called the ‘Monthly Savings (Weekly) 20+ Run.’ This product offers a base annual interest rate of 1.8%, with potential preferential rates of up to 4.8 percentage points, resulting in a maximum annual rate of 6.6%.

The preferential rates are structured as follows:

- 2 percentage points for achieving over 90% of payment installments

- 1 percentage point for participating in the Shinhan 20+ Run

- 1 percentage point for registering a race completion certificate

- 0.8 percentage points for not holding any Shinhan Bank deposits or savings accounts in the past six months

This innovative approach aims to reward customers for both their financial discipline and commitment to fitness.

Samsung Fire & Marine Insurance Introduces Running Insurance

Samsung Fire & Marine Insurance has launched the ‘Whenever There’s a Chance, Running Insurance,’ which provides coverage for injuries related to running or walking. The insurance offers a diagnostic benefit of 100,000 Korean won for foot or leg fractures, and 200,000 Korean won for hip or pelvis fractures. It also covers surgery for foot, ankle, or leg fractures up to 200,000 Korean won, and hip or pelvis surgery up to 400,000 Korean won.

The daily premium for this insurance is approximately 630 Korean won, and customers can enroll on the same day. Unlike traditional insurance, this product allows customers to choose coverage periods of up to one year. Samsung Fire & Marine Insurance is actively targeting young runners by sending insurance-related messages to marathon participants.

Carrot Collaborates with RunDay for Marathon Participation Opportunities

Carrot, the digital brand of Hanwha General Insurance, has partnered with the running platform RunDay to create an event that offers overseas marathon participation rights to customers. This initiative is seen as a strategic move to promote Carrot, which was acquired last month.

Participants who registered via the Carrot app and RunDay app were eligible for a lottery after completing a four-week running mission. The prizes included:

- Full-course participation right for the Sydney Marathon in Australia

- Half-course participation right for the Da Nang Marathon in Vietnam

- Round-trip air tickets

- Accommodation

- Pre-running training

To qualify for the lottery, participants had to run a cumulative 100 km or more over 10 sessions, with each session requiring a 2 km run at an average pace of under 10 minutes per km.