The Role of Cybersecurity in the Financial Sector

The United States economy is deeply intertwined with the financial services industry, which has long been a driving force behind market development, innovation, and trade facilitation. Financial institutions are essential for capital creation and productivity, making them significant contributors to the country’s gross domestic product (GDP). However, the increasing threat of cyberattacks has raised concerns across all sectors, especially within financial institutions. Cyber actors, including criminals and geopolitical entities, target these organizations due to the unique nature of the financial sector. Successful breaches can yield immediate or future financial gains through data sales. The shift to hybrid work models and technological advancements have exposed financial institutions to new risks, such as systemic threats. Furthermore, reliance on third-party services and cross-border operations may amplify these vulnerabilities.

Cybersecurity involves the measures and programs that organizations use to protect their information technology infrastructure, including networks, software, systems, and data, from exploitation or attack. While the need for robust cybersecurity plans is relatively recent, organizations have long engaged in activities to safeguard their information assets and sensitive private data. Traditional methods such as physical protection around paper-based records, using passwords, and implementing physical keys to restrict access to electronic security systems and computers have been used to achieve these goals.

Despite these efforts, cyber and technical threats have emerged that can bypass many successful precautions. With the growing number of computer networks and organizations, interest in cybersecurity has surged significantly. As a multi-billion-dollar industry, many organizations across various sectors are focused on creating and implementing cybersecurity programs to defend against prevalent incursions and attacks. Many of these systems incorporate a risk mitigation strategy, prompting organizations to concentrate on the threats most likely to exploit vulnerabilities that cause harm to the organization. As cybersecurity continues to evolve, organizations must persist in developing and implementing robust security measures to protect their information assets and sensitive private information.

The Importance of Cybersecurity in a Globalized World

In a globalized world, economic interdependence has increased, with political conflicts, wars, and crises impacting the economies of all states. Therefore, the security and resilience of the financial and economic systems are crucial under both domestic legislation and international treaties. Cybersecurity is a fundamental requirement for the financial system, ensuring smooth operations and fostering trust in its proper functioning. It is not merely a specialized public benefit, but a public asset that protects private consumers of financial services and the entire economy in a connected world. Cybersecurity is no longer a personal choice for financial organizations and their owners; it is the responsibility of financial institutions to adhere to rules and comply with regulations. Regulatory agencies are tasked with monitoring and supervising compliance among these institutions, including cybersecurity. International banks, regardless of their location, are subject to scrutiny and oversight regarding cybersecurity.

Financial organizations must prioritize cybersecurity to protect their private information and money, as it is crucial for safeguarding the entire financial system. Ignoring cybersecurity can lead to disastrous and expensive results, as it can cause panic in the financial system and lead to consumers avoiding using financial institutions and losing trust. To combat this, organizations should establish a cyber-awareness and organizational culture among staff members and invest in strong cybersecurity technologies, like software.

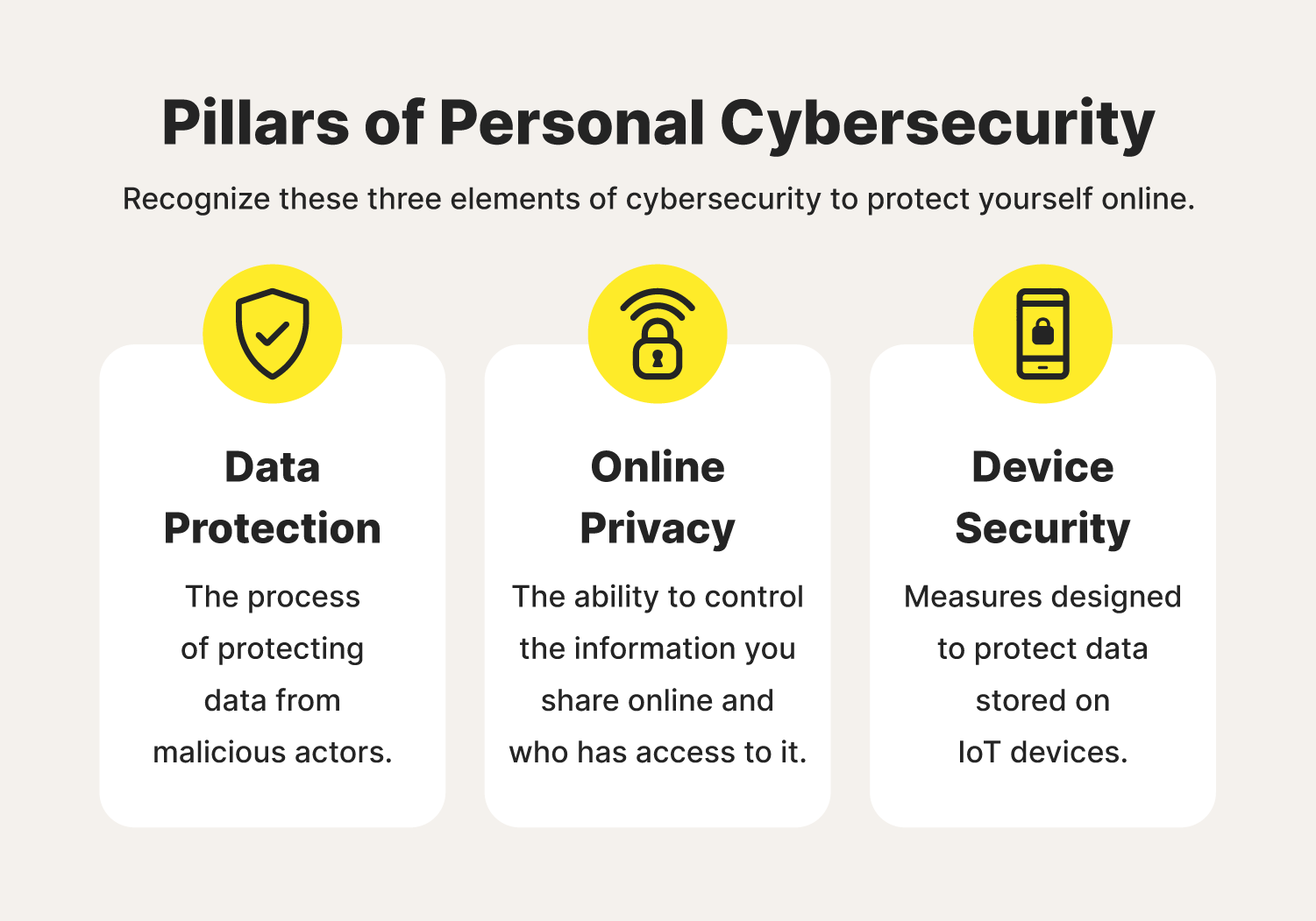

The Three Pillars of Cybersecurity

People, process, and technology together define cybersecurity, and every financial institution depends on these three pillars. People are the first layer of protection against attacks on systems and sensitive data. Encouraging staff members to understand the hazards related to working in financial institutions is essential to prevent reckless behavior that can undermine security. Continuous training and investment in simulation technologies can help employees be responsive to data privacy and security. Employees handling sensitive data should be given top priority at financial institutions to reduce the possibility of data leaks. Financial institutions have a great need for cybersecurity, which they must always follow strictly. The security scene and attack surface have rapidly expanded with internet enablement, services transfer to the cloud, mobile and endpoint proliferation, and the start of the epidemic. Cyber attackers are increasing the frequency and potency of their assaults using more advanced technology. The consequences of a cybersecurity breakdown could be enormous and cascade effect.

To ensure institutional resilience and effectively prevent, detect, mitigate, and respond to incidents that could escalate to a cyber impact, for example, in the United States of America, the Department of Homeland Security has been required to develop a plan to improve the cybersecurity of financial institutions. This includes identifying important sectors of operations, which include local and international cyber hazards that could compromise such areas.

Strengthening the Cybersecurity Framework

The three main pillars—people, process, and technology—must be strengthened according to a complete cybersecurity model. Visioning that includes technology fencing alone will never provide the intended result; it must be combined with people training, workforce uplifting, and specified operational procedures. In today’s digital world, banking has extended its reach to be more customer-friendly. Banks must explore, invest, deploy, train, and combine suitable technology that caters to best practices with minimal fear but without compromising the fundamental idea of cybersecurity – i.e., detect, deter, delay, comply, and recover.

Cybersecurity education is a crucial foundation for maintaining the effectiveness of cybersecurity systems. Companies should provide staff members with knowledge on various hazards and dangers associated with cybersecurity events, as well as shared best practices to lower these risks. Organisations should customise training for specific groups of workers and ensure frequent updates as the danger scene evolves. Self-assessments and evaluations can help assess awareness to ensure that organisations address knowledge transfer, meeting workers’ vital requirement for cybersecurity expertise.

Identifying cybersecurity events depends on employees, who are the first line of detection, informing the company about hostile behavior. Companies must create a culture that supports security, allowing staff members to document events without fear of reprisal. Financial organisations face challenges in developing mature security awareness programs due to the variety of staff backgrounds and duties. Training should be continuous and relevant to the target audience, with subjects such as email attack simulations, two-factor authentication apps, malicious advertisement links, phishing, USB drop, vishing simulations, encryption/transmission policies, safe coding/testing techniques, and best practices on preventing data leaks.

Adapting to Evolving Threats

Cybercriminals are increasingly using human mistakes to launch their attacks, such as phishing emails, pretexting, and social engineering techniques. While technology can control cybersecurity risks, workers must reduce risks that technology cannot control. Highly educated workers can change the cybercrime success rate by raising employee trust and confidence. Ensuring that training is tailored to every employee group and includes industry-related scenarios and situational training can improve the success of company training plans. Employees must be aware of not just phishing and social engineering efforts, but also sophisticated hackers using artificial intelligence software to voice-change to pass as executives or CEOs. Pretexting, where attackers pose as top executives and ask for private consumer data, is a new wave of attacks that can be targeted by law enforcement. Building a security culture is a difficult and ongoing task, as it requires balancing trust and control between employees and the organisation’s resources. A good security culture is a set of personally held values combined with formal definitions of and consequences for behavior, matching individual goals with the organisation’s goals.

Technical Protections and Compliance

Technical protections and cybersecurity solutions are crucial for maintaining a company’s cyber safety. Companies should ensure that all staff members follow the correct policies and processes to maintain their organisation’s cybersecurity. This includes policy formulation, risk assessment and management practices, incident response planning, compliance and regulatory frameworks, and vendor management. Lack of knowledge and training can lead to successful cyberattacks.

Management of risk analysis is essential for establishing a good cyber hygiene program, which starts with cyber risk assessment. Working together, cyber threat and vulnerability detection and reporting, anomaly detection and reporting, and control evaluations help preserve good cyber hygiene over time. Organisations must decide their risk tolerance regarding jurisdictional regulations and provide measures that deal with organisational responsibility and decision-making.

Incident response strategy is vital for companies to be prepared for events and distinguish those whose operations and reputations are compromised for prolonged durations. The first keystone of a financial institution’s cybersecurity structure is risk assessment and management. Conventional risk assessment techniques should focus on the potential for loss from business interruption events, information theft or corruption, and regulatory fines and penalties. Cyber insurance and other cyber risk management tools should be included in the overall risk management strategy.

The Technological Pillar

The technological pillar is responsible for delivering advanced security solutions that prevent intrusions and protect data integrity. Financial institutions can use various technologies and tools, such as hardware and software firewalls, identity and access management solutions, cybersecurity awareness training programs, and DDoS protection scrubbing solutions. To implement modern cybersecurity solutions, businesses need a cybersecurity technology stack that includes password managers, multi-factor authentication, antivirus and antimalware, endpoint protection platforms, web application firewalls, virtual private networks, security information and event management, encryption, intrusion detection and prevention, unified endpoint management, and cloud security posture management.

Mistakes in setup and rules can lead to delays, poor performance, and wasted expenditures. Managed service providers can ensure the technological stack is up-to-date with new installations and organisational changes, monitor its efficacy, and handle configuration and integration challenges. Companies can also outsource technical management to managed service providers. Machine learning ML and artificial intelligence technology enable cybersecurity teams to study massive amounts of data and react more quickly, enabling early warnings and detection of breaches. Companies should continuously evaluate the performance of their AI and ML systems and closely examine existing procedures. Technology-driven automation may be the most suitable option for smaller events. Frequent patching and updates are essential for cybersecurity systems and components to remain updated with new actors and threats.

Challenges and Future Trends

Financial institutions face significant challenges in maintaining cybersecurity in today’s digital world. Threat actors attack financial institutions due to their data, causing devastating physical, reputational, and financial impacts. They are constantly in demand, and their 24/7 availability is crucial for the economy. Cyberattack techniques and services change frequently, making it difficult for cybersecurity teams to recover. Advanced technologies like artificial intelligence and cloud computing can launch major attacks on financial institutions, but they can also detect some attack types, such as threat-hunting algorithms or security automation using machine learning.

The internet and mobile communications have complicated financial institution governance, providing hackers with unique opportunities. Cyberattacks have increased in quantity, complexity, and impact as institutions become hyperconnected via online transactions and digitalisation across their value chain. A successful cyberattack may undermine the institution’s safety and soundness, hurting services, finances, consumer trust, and reputation. Regulatory agencies have prioritised cybersecurity, with financial authorities worldwide assessing institutions’ cybersecurity risk management policies and vulnerability reduction efforts due to the present cybersecurity threat. The globalisation of the banking industry has increased collaboration and creativity while posing new risks. Financial businesses must balance user satisfaction and security to maintain customer satisfaction while protecting their assets.

Budget Constraints and Emerging Technologies

Cybersecurity is tough for financial institutions due to budget and resource constraints. They must balance cybersecurity with revenues and consumer value, and they worry about resource allocation. IT and security teams handle cybersecurity, but other departments may directly impact outcomes. Authorities allocate resources nearly automatically, such as forcing institutions to build a minimum technology estate. Cybersecurity budget considerations are complicated by changing demands for defense against low-cost or no-cost attacks. Successful attacks are easy to prove, but financial efficiency is harder.

Cybersecurity is rapidly developing, with global security expenditure now at almost $150bn. However, the widening security gap is evident as threat actors scale up in terms of ambition and skill. CCTV breaches reveal that 850,000 user details were exposed in a notable attack, and a study at the end of this year disrupted 13 distinct assault operations, infecting computers all over with malware using pre-existing vulnerabilities on those devices. To defend themselves against cyberattacks in the next years, companies will have to double or even triple their expenditures on cybersecurity.

New technology trends include bug bounty programs, ethical hacking, and biometric authentication. Advances in artificial intelligence and quantum computing will lead to the eventual collapse of password-based authentication, creating a robust market for post-quantum cryptography. Nation-states will continue fighting subterranean economies with advanced hacking capabilities in line with a second cyberarms race. Information systems are often slow to adopt new technologies, especially for financial organisations. The cost involved, legacy systems, and low-risk character of these systems rank highest among the factors. Errors in information systems may cause system freezes, client discontent, and income loss. Financial services and associated infrastructures will soon follow the trend towards the fast adoption of technology breakthroughs, altering many other areas of the economy.

The Future of Cybersecurity in Finance

As we approach the third decade of the 21st century, many technologies have developed to maturity, such as real quantum cryptography systems, fully homomorphic encryption, and strong computing general processing units. As we approach the next decade, hypotheses are proposed that will have some effect on our area of study. Ten years from now, a quantum internet will be possible, enabling resources accessible to our field and planet that will revolutionise both. Semantic security will be achieved from post-quantum algorithms, and completely homomorphic encryption will achieve operational feasibility and beyond.

Finally, financial institutions cannot afford to ignore their cyber defence posture as the scene of contemporary financial services changes. Ensuring the resilience of these institutions depends on the early identification, prevention, and mitigation of cyberattacks using a thorough, multi-layered defence plan addressing the particular character of the financial sector cyber threat. Financial organisations may start to create a varied cyber defence posture that runs as a whole instead of autonomous silos by concentrating on the three fundamental cybersecurity pillars of people, technology, and processes. These pillars have to be built to resist the particular challenges of the financial sector cyber threat, including its coordinated, persistent, and opportunistic character, the always changing tactics, techniques and procedures used by threat actors, the degree of difficulty associated with spotting cyber threats inside financial systems, and the critical relevance of reactionary speed in the early detection, prevention, and mitigating phases of an incident. The financial services industry is still adjusting to how best to handle the problem of cybersecurity protection and the rising complexity of threat actors. Present rules in the industry mostly concentrate on readiness and mitigating strategies instead of defence. Nonetheless, the most important area of attention for both institutions and authorities should be providing means of allowing preventative strategies that may stop efforts at cyberattacks before they start.

Adebisi is a cybersecurity expert with Soams Consulting PlcProvided by SyndiGate Media Inc. (Syndigate.info).