The Growing Crisis in EV Battery Manufacturing

Battery manufacturers are encountering a significant demand crisis, according to a recent report. The capacity to produce electric vehicle (EV) batteries is far exceeding global demand, which poses serious financial risks for battery makers. This issue is particularly severe in China, but it’s not isolated—overcapacity exists in every major market.

The high material and production costs of EV batteries mean that electric vehicles are often not cheaper than gas-powered cars, which further reduces demand. This has led to an unexpected problem in the electric vehicle world: too many batteries. According to a report by consulting group AlixPartners, the capacity to build EV batteries outpaces demand in every major market. In North America, there is 1.9 times as much capacity as demand, while in Europe, the ratio is 2.2. In China, the situation is even more extreme, with 5.6 times as much battery-building capacity as there is demand for batteries.

Challenges in the Global Market

With tariffs restricting Chinese EVs and components from major markets, it’s a challenging time for Chinese battery suppliers. However, the situation isn’t much better elsewhere, as explained by AlixPartners Senior Vice President Rohit Gujarathi. He noted that globally, the difference between five times and three times the demand is not significant. At this moment, the capacity is still way beyond what the demand is.

Even though North American capacity looks better on paper, it faces challenges. For instance, there is very little local production of lithium-iron-phosphate (LFP) batteries, which offer lower costs and better durability at the expense of density. Despite this, there’s little incentive to build new capacity right now, as existing plants are already overbuilt for current demand.

Factors Contributing to Overcapacity

Several factors have driven overcapacity in specific markets. Heavy incentive spending in China, the U.S.’s own EV incentives, and the European Union’s aggressive regulations have all played a role. However, the main issue remains consumer behavior. Consumers have not responded to the surge in electric options as anticipated by automakers, experts, and regulators.

Gujarathi highlighted that the primary reason for this lack of response is cost. “What consumers care about is: ‘What’s the price of the vehicle?'” he said. “Does it make economic sense to me?” He added that in most cases, it doesn’t, especially as government support has been reduced. Despite abundant supply pushing down prices, EV battery production and material costs remain high, making it difficult for companies to sell them for less than they cost to build.

Impact of Policy Changes

This situation comes as the U.S. has removed its federal tax credit and rolled back emissions standards that previously pushed automakers to offer zero-emissions vehicles. The result is likely a contraction in the EV market, although the extent of the drop is uncertain. The numbers from last month were not great, but they also reflect that many consumers pulled forward purchases to take advantage of the tax credit before it expired on September 30.

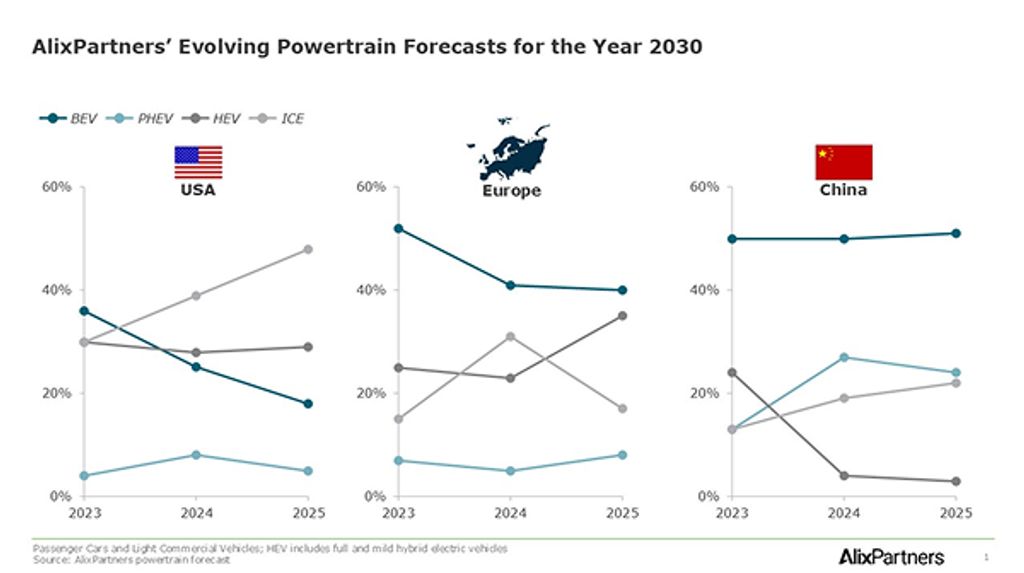

AlixPartners expects the capacity-to-demand ratio to grow to 2.4 by 2028 and stay around that level through 2030. This reflects the firm’s earlier revision of North American EV penetration in 2030. Last year, it predicted that 36% of new vehicle shoppers in the U.S. would buy EVs in 2030. This year, it revised that figure down to 18%—a 50% drop in predicted demand.

Future Outlook and Industry Adjustments

Experts Predicted An EV Sales Collapse. It’s Already Started

Here’s How Ford’s $30,000 EV Truck Is Going After China’s BYD

Honda Had Big Plans For Affordable EVs. Here’s What Went Wrong

It’s Not Just The Bolt. A ‘Family’ Of Low-Cost EVs Is Coming, GM President Says

The result will likely be further consolidation of existing battery plants and efforts, including deals like the one in which General Motors sold off its stake in a battery plant it once shared with LG Energy Solution. Gujarathi said he also expects to see companies launch LFP battery factories in the U.S. to address the cost problem.

This trend aligns with the fact that GM is already using North American LFP batteries in the new Chevy Bolt. However, overall demand for these low-cost EVs remains unproven, so expect companies to stay agile. Some companies have tried to divert EV battery production plans to make energy storage systems instead. Regardless of how exactly companies manage the excess supply, the uncertainty of today’s market is certain to impact the future of affordable EVs.

Preparing for an Uncertain Future

“What this means is holding back on some of the investments that may happen in the future,” Gujarathi said. Companies have to prepare to swap out technologies, battery chemistries, and model plans as the situation develops. “Everybody right now is in a holding pattern, because the ground is shifting underneath them,” he said. It may be like that for quite a while.

Key Trends and Projections

A graph of projected demand for vehicle powertrain types.